Shipping & Logistics

Container Shipping

According to JOC, container carriers do not expect a significant market recovery in the coming months, thus they are extending their capacity reduction programs in the third quarter. THE Alliance and 2M announced 75 sailings will be canceled through September, while industry analysts expect Ocean Alliance to reveal a new blank sailing program soon.

Before the new adjustments, the three alliances had announced a total of 126 void sailings on the trades between Asia and North America through August as a result of the impact of the coronavirus on demand, and 94 blanked sailings on Asia-Europe, according to Sea-Intelligence Maritime Consulting.

The 2M Alliance will suspend its joint Asia-Europe AE2/Swan and AE20/Dragon services for the full third quarter, removing 22 percent of their capacity from the trade. However, Sea-Intelligence pointed out that the fortnightly Griffin service to be deployed by MSC on both the Asia-North Europe and Asia-Med trades in the third quarter would offset the blank sailings, reducing capacity to 18 percent.

An improvement in demand on the Asia-Mediterranean trade will see THE Alliance reinstate some services from June, while other planned blank sailings on the trade will extend only to the end of July.

The withdrawal of significant amounts of vessel supply has kept spot rates way above levels seen at the same time last year, as declining vessel capacity could not keep pace with an increase in import volumes driven by inventory replenishment. Another effect of the extensive capacity reductions is an increase in ship utilization on the Asia-North Europe and Asia-Med trades, meaning huge call sizes, with a reported container exchange in some European ports above 10,000 TEU per call.

World Ports

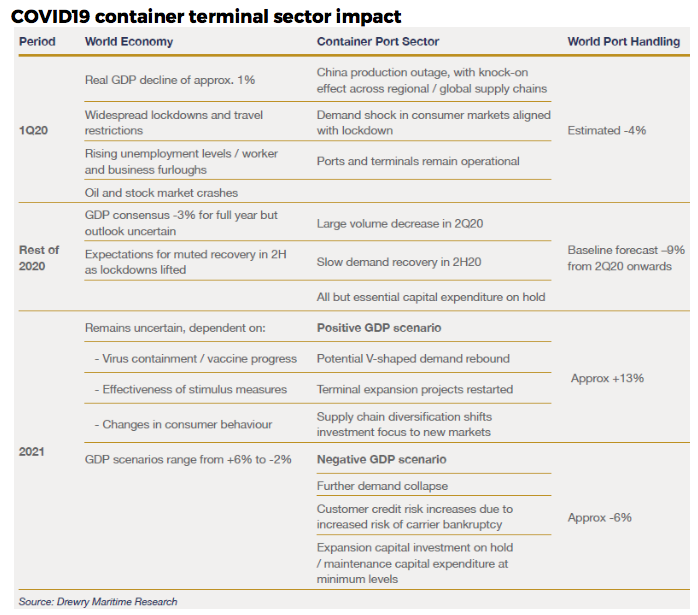

Drewry’s new Ports & Terminals Insight highlights that for the eighth consecutive quarter global port throughput growth has slowed, falling to 0.3% in 1Q20, against 1.9% in 4Q19, while a steeper downturn in port handling is expected in 2Q20 as lockdown measures have spread around the globe.

Drewry reports that a consensus is forming among leading economists that global GDP will fall by around 3% in 2020 with 2Q20 undoubtedly worse than 1Q20.

Hopefully, some recovery will take place in 2H20 as lockdown restrictions are lifted, although analysts agree that significant downside risks remain – either a more prolonged or second-wave outbreak.

Notably, it is the advanced economies that will suffer the worst, with IMF projecting a 6.1% reduction in 2020, compared to a 1% fall for emerging markets and developing economies.

According to the UK-based experts, following a likely slow demand recovery in the second half of the year, 2020 container volumes are expected to be 9% lower than in 2019.

Aligned with the different IMF scenarios, Drewry’s container market outlook indicates two possible trends for world port handling in 2021.

The positive case, based on the assumption that world GDP will rebound +6% next year, estimates a possible growth of global container throughput around 13%. On the other hand, if a less favourable economic scenario is considered, with GDP falling by 2% in 2021 and causing further demand collapse, world container handling is expected to drop by another 6%.

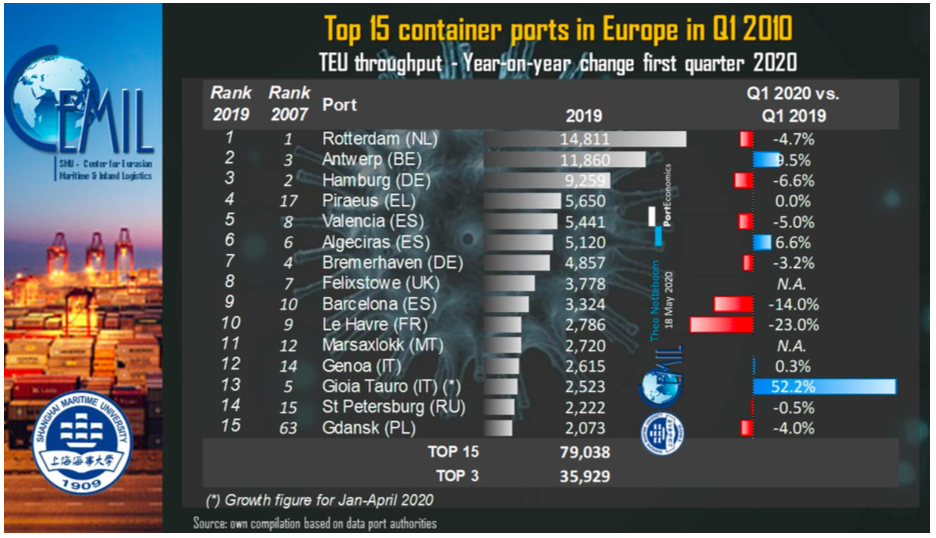

European Ports

According to Port Economics, the supply shock registered in China last February, when the factories were unable to operate due to the diffusion of the COVID epidemic, generated a wave of container ships blank sailings, which resulted in a drop of container flows in European Ports in March.

Prof. Theo Notteboom indicates that in mid-March the picture turned around as production resumed in Asia, but demand dropped in Europe due to the lockdown measures.

This has led to an additional wave in blank sailings with carriers withdrawing up to 20% of their network capacity on the main trade lanes. The second wave of blank sailings will significantly affect Q2 2020 volumes in European ports, but does not show in the Q1 2020 figures.

Most of the European Top 15 monitored by Port Economics marked negative growth figures in Q1.

Mediterranean transhipment hubs Gioia Tauro and Algeciras and the mixed transhipment-gateway port of Antwerp are the only ports posting strong growth.

Among gateway ports, the port of Genoa and the port of St. Petersburg were the only able to confirm the same level of 2019.

In Northern Europe, Antwerp and Zeebrugge recorded a strong performance, in sharp contrast to the situation in other hub ports of the Le Havre-Hamburg range.

In the Mediterranean, Barcelona registered a steep 14% drop in container volumes, mostly attributable to the decline in transhipment traffic. Valencia had to accept a 5% volume drop, while on the East side, Piraeus registered only a moderate decline.

Tag: