Global Economic Trends

ISPI's Geoeconomics report claims that the international logistics chain will be severely affected by the effects of the economic crisis caused by the Covid-19 pandemic, estimated by IMF in a 3% global GDP contraction in 2020 and by WTO in a 32% collapse in world trade.

At the global level, according to the Institute for Supply Chain Management, during March 75% of logistics companies reported interruptions in their supply chain due to transportation restrictions and 46% of international logistics companies experienced significant delays in flow of goods between China and Western markets.

The maritime transport sector, one of the pillars of globalization, is at the center of this economic storm, and it will be affected also by the restructuring of global value chains, with a likely progressive trend towards regionalization of supplies.

Meanwhile, the lower demand for goods and raw materials pushed freight rates downwards, as shown by the collapse of the Baltic Dry Index, which has been progressively weakening since December 2019 due to the world economy slowdown.

Ports

IAPH (International Association of Ports and Harbours) is conducting a weekly survey among world ports on the impact of COVID-19 on their activity. Overall, disruptions have been limited and most ports are able to continue operations and remain open for trade.

Over 40% of the ports experience a moderate decrease in the number of container ship calls, while the cruise market remains the most affected, as most shipping companies have suspended their activity and 28% of the ports have discontinued passenger operations.

Mandatory ship sanitization certificates and specific COVID-19 protocols have been introduced in some countries: 59% of the responding ports have not imposed any additional restriction on passenger ships and more than 75% on cargo vessels. Anyway, only 8% of the ports report delays for container vessels and only 4% for other cargo ships. A common problem is road haulage due to widespread restrictions to delivery of non-essential cargo.

Working from home is becoming a regular practice for administrative personnel, while operational workers have to respect stringent safety measures. A few ports report the need to put a part of the dockworkers on a temporary layoff due to activity reduction.

Shipping & Logistics

The coronavirus pandemic is affecting the global shipping sector. Collapsing demand from restrictions adds further pressure to a market already oversupplied and the strongest effect have been seen on the megaships segment.

According to the Wall Street Journal, Ocean carriers have canceled more than 380 sailings since February across the world’s busiest trade routes, stopped ships and sent vessels on longer voyages to reduce capacity and preserve their finances amid diving trade volumes. But the ultra-large ships that have come to dominate container fleets in recent years continue to sail half empty.

The megaships have been built since 2013 in order to maximize the economies of scales and improve efficiency, as they provide large operating-cost savings on major trade lanes in periods of high demand.

Nevertheless, in the current unpredictable market, the big vessels can not provide the flexibility needed to adapt to sharp fluctuations between supply and demand, and some shipping companies seem to be questioning the rationale for this ships.

Ports of Genoa

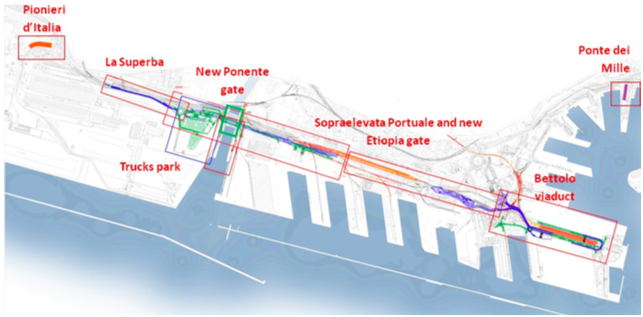

Plans are onstream to implement a range of major infrastructure projects in the Ports of Genoa over the coming years that will optimize access both landside and shoreside. The impact of the collapse of the Morandi bridge has highlighted the strategic importance of road infrastructure projects for the development of the port. The aim of these interventions is to review port access across new roads, new parking areas and the upgrading of existing facilities, assisted by an intensive use and expansion of technological and digital tools, in cooperation with the port community stakeholders.

The Sampierdarena Basin infrastructure projects, incorpororated within the Genoa Emergency Port Investment Programme, break down into ten different specifications and include a port road traffic management study that analyses current and future flows, indicating an expected 4,100 trucks per day in the short-term, and 4,800 trucks in the medium-term, compared to the current 3,500 trucks per day.

The planned interventions will feature new smart port gates and parking areas, in addition to a general improvement in the performance of the port road network, together with an upgrading of the terminal gates.

The total cost estimate of the Sampierdarena Basin projects is approximately 130 million euros. The Technical-Economic Feasibility Project was completed in September 2019, also in cooperation with all the stakeholders involved across public consultations. The definitive project commenced in February 2020 and, notwithstanding the challenges posed by the COVID-19 lockdown, it is scheduled to be completed by June 2020, followed by the authorisation phases and the implementation of the executive project. The construction works are set to start at the end of 2020 and to be completed in 2023. The definitive project represents one of the key phases and, despite the COVID-19 emergency, it is proceeding in line with the timescale established across a close collaboration between the engineers, Ports of Genoa management and all parties involved.

During this period, technical analysis are underway, aimed at defining the detailed structural elements by outlining the requirements of all the parties involved, across remote technical team meetings. The Ports of Genoa’s plans are all in place to guarantee the pre-established deadlines to equip the ports with the infrastructure required, to cater for the future challenges imposed by the impact of the Covid-19 emergency on port traffic.

Tag: