Global Economic Trends

IMF claims that China’s economy, though affected by the effects of the economic crisis caused by the Covid-19 pandemic, is expected to see a recovery in the second quarter of the year thanks to the firms re- opening and the return of employees to work in March.

Although Europe’s economy appears to have collapsed in April. According to IHS Markit, the European PMI (Purchasing Managers Index), the forward-looking indicator meant to signal the direction of activity in the manufacturing and services sectors, fell from 44.5 in March to 33.6 in April. The manufacturing output index fell from 38.5 in March to a new record low of 18.4 in April, caused by the closure of many non- essential companies and the delay in the distribution chains for those who remained open.

Markit stated that the decline in the PMIs in April was consistent with GDP falling at a quarterly rate of 7.5%. It’s likely there won’t be a significant easing of restrictions until mid-May, in which case economic activity will remain stifled for much of this quarter with still lower PMIs in the next months.

Ports

As more than 80% of goods are transported via sea-lanes, ports and maritime sector play a crucial role in keeping trade flows open, that's the reason why the Port Authority Roundtable, the organisation that gather 20 port authorities in the world, from Singapore to Antwerp to Long Beach has recently signed an agreement to ensure its ports remain open amidst the current pandemic. The declaration calls for PAs also to collaborate and share best practices in ensuring that port operations can remain undisrupted.

Shipping & Logistics

The coronavirus pandemic is affecting the global shipping sector leading Standard and Poor’s to downgrade its outlook for the future health of three of the major European container carriers.

It is believed that global trade volumes will plunge by up to 15% in 2020 compared with 2019 and that carriers will see an earnings decline of 15% -20% .

Ocean carriers have cancelled more than 435 sailings since February across the world’s busiest trade routes and others reroute backhaul voyages to Asia around the Cape of Good Hope, thereby saving money on Suez Canal fees at a time of low bunker prices, but increasing from 7 up to 10 days their voyages.

The Covid-19 has also affected the air cargo logistics which is many times costlier than overland shipping or cargo ships, but worth it for fresh or urgent cargo. With no passengers filling aircraft seats as demand dwindles in the wake of the pandemic, an increasing number of airlines are now piling cargo in the cabins of their aircraft in the hope to generate at least a fraction of the revenue they would have generated under normal circumstances.

Ports of Genoa

Tax revenues (Port tax, cargo surcharge, port security tax and mooring tax) represent a conspicuous element of Italian Port Authorities incomes, over 50% in the case of Ports of Genoa.

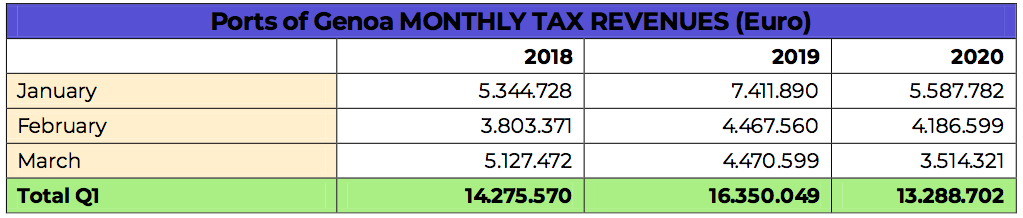

In line with cargo throughput, tax revenues are extremely sensitive to changes in the economic scenario: during the first quarter of 2020, coinciding with the spread of the Covid19 pandemic, a significant decrease in tax revenue (over 3 million euros, -18.7% compared to 2019) was registered by the Ports of Genoa.

The monthly trend of the last three years shows a slight decrease in February (-6.2%) compared to 2019, and a severe drop in the months of January (-24.6% ) and March (-21.4% ).

The decline was particularly severe in March, when the Government introduced the suspension of the mooring tax until April 30 2020, as a support measure to the shipping sector, harshly hit by the COVID emergency.

In addition, the diminished 2020 values reflect the significant reduction in cargo surcharge dues instituted since March 2019 to compensate for the effects of the collapse of the Morandi bridge on the supply chain.

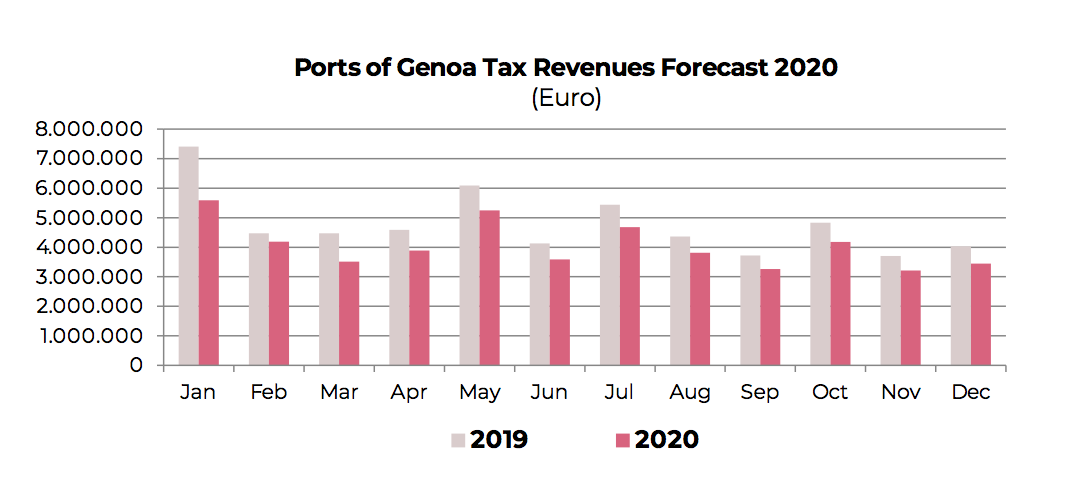

Considering the ongoing downward traffic trend, in 2020 a -15% overall reduction of port tax revenue compared to 2019 is expected in the Ports of Genoa, corresponding to a loss around 8.6 million euros.

Tag: