This is the last issue of our COVID-19 Update.

We will come back soon with new formats to keep you connected with the Ports of Genoa.

Container Trade Scenario

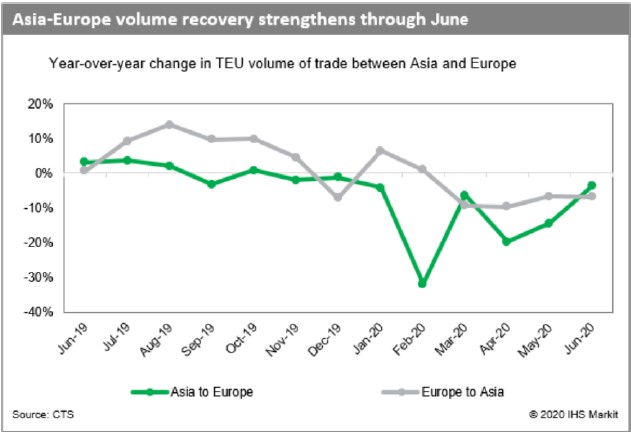

Asia-Europe trade

According to JOC, volumes on the Asia-Europe trade are rapidly improving and bouncing back from the lows seen in April during the height of the COVID-19 lockdowns. Asia to Europe container volume in June was 1.39 million TEU, down just 3.8 percent from the year-ago month, while volume fell by almost 20 percent in April and by 14.5 percent in May.

BIMCO claims that during the incoming peak season the result of 2019 will not be equalled, but volumes of 2018 might be reached. In the most likely scenario volume will drop 5 percent from July through December compared with the second half of 2019, which would be a significant improvement compared to the result of first half of the year. Nevertheless, demand in Europe has not recovered yet and job loss still is a major concern, limiting the prospects of containerized goods imports: improvements in volume can be seen, but the market is still far from the pre-COVID-19 situation.

Sea-Intelligence Maritime Consulting confirms that although container data indicate Asia-Europe trade has passed the peak impact of the pandemic, the demand is still “highly negative,” with global market volume having declined by 5.7 million TEU in the first half compared with the first six months of 2019.

Nevertheless, according to IHS Markit forecast, container volume on Asia to Europe and Mediterranean routes in 2020 will be 16.19 million TEU, a 2.6 percent year-over-year increase.

Despite growing volume, carriers announced the blanking of 189 sailings through September. This contributes sustaining spot rates levels well above those of last year (Asia-North Europe +32%; Asia-Mediterranean +33%). However, Asia-Europe has seen 18 of the scheduled blanked sailings reactivated in the past few weeks.

According to UK-based forwarder Davies Turner and Co, the Asia-Europe trade is overshadowed by the regular outbreaks of the coronavirus that are being reported in Europe, resulting in targeted regional lockdowns. Thus, shippers are reluctant to import large volumes from China for fear that a second wave of the coronavirus could lead to more widespread lockdown measures. Although volume is recovering on the trades out of Asia and space is tight because of the high level of blank sailings, significant uncertainty still affects the market, thus no major volume peaks are expected over the next quarter.

Europe-North America trade

According to Alphaliner, Europe-North America trade remains under COVID-19 pressure.

The Europe - North America trade is not yet enjoying increased cargo demand, as is the case for the two other East - West trades. Whereas most blanked sailings have already been reinstated on the Transpacific and extra sailings are now being offered from Asia to North Europe to accommodate all the cargo volume during the summer peak period, more void sailings in September have already been announced for the Transatlantic trade as cargo demand is still affected by the COVID-19 pandemic.

Average weekly vessel capacity in the Europe-North America trade in July stood at almost 136,500 teu, which is 6,650 teu or 4.8% less compared to last year.

MSC and Maersk have made the biggest efforts to reduce capacity as they have temporarily halted one of their four joint 2M loops between North Europe and the US East Coast (until the end of August). 2M is the only alliance having suspended an entire service.

MSC remains the largest carrier in the Europe - North America trade with a market share of 29.1% despite a 12.4% capacity reduction since July last year.

Hapag-Lloyd is the second largest carrier between Europe and North America with a market share of 22.8%. The German shipping line has even increased its offering in this trade by 8.3% in the last twelve months.

The biggest growth on the route (+48.9%) has been realized by the COSCO Group (including OOCL), while Maersk has cut its capacity on the route by 17.5%, but remains the third largest carrier with a reduced 12.5% market share, and THE Alliance is reducing capacity by blanking sailings of its North Europe – US East Coast ‘AL1’ and ‘AL4’ services.

Ports in the global liner shipping network

UNCTAD has recently analysed the number of container ports in the world receiving regular liner shipping services. In the 2nd quarter of 2020, 939 container ports were involved and, if all ports had direct services between each-other, there would be 440,391 direct port-to-port connections. In reality, however, only 12,748 port pairs have such direct connections (2.9 % of the theoretical total). For trade between the remaining 97.1 per cent of port pairs, containers need to be transhipped in other ports. The least connected port pairs require up to 6 transhipments, with 7 direct port-to-port services and 14 port moves for one trade transaction.

Shanghai is the best-connected port in 2020 with 288 direct connections, followed by Busan (274), Antwerp (268) and Rotterdam (264). In Africa, Tanger Med has the highest degree (137 direct connections), and in South America, Cartagena is the best-connected port under this criterion (130 direct connections).

In a rank largely dominated by Asian ports, the port of Genoa is globally ranked as 20th in term of numbers of direct connections, with 146 links to other ports. Looking at only European ports, the port of Genoa is classified as 7th, remaining by far the first Italian port ahead of Gioia Tauro (117 direct connections) the only other Italian ports recorded in the top 50 global ranking.

Comparing the current scenario with the situation recorded in 2006 (the first year of the UNCTAD analysis), the following changes in the network can be observed:

- The number of container ports in the network has increased by 13%, from 834 to 939, but a reduction of direct port-to-port services has been recorded.

- The centre of the network in terms of the largest nodes and the position within the network has shifted from Europe to Asia. The 3 ports that most improved their degree are located in China (Nansha, Ningbo, and Shekou), while the 3 ports that saw the largest decline are in the UK (Tilbury and Felixstowe) and Venezuela (Puerto Cabello).

- The share of port pairs that count on direct services decreased from 3.7 per cent in 2006 to 2.9 per cent in 2020, reflecting a trend towards the use of transhipment services.