Shipping & Logistics

World Ports

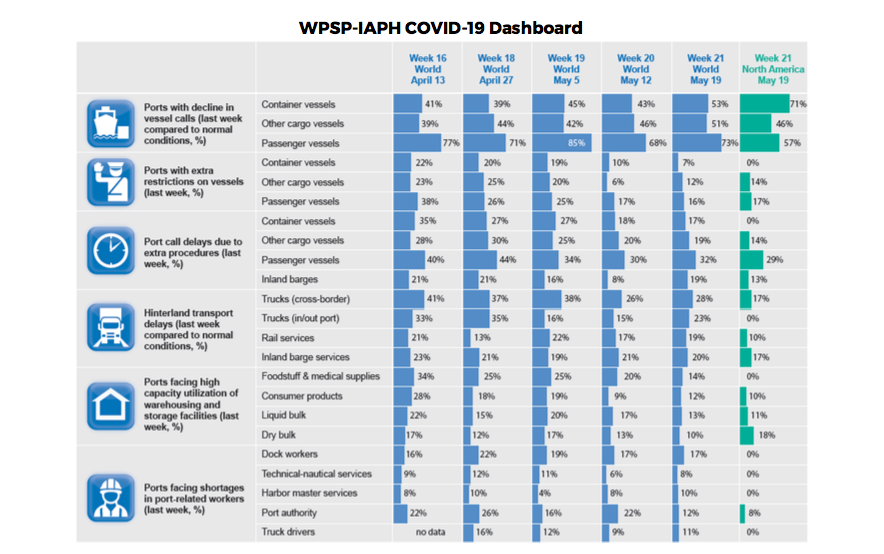

According to the new edition of the IAPH Global Survey on impact of COVID19 on ports, an increasing number of ports (53%) are reporting that the number of container vessel calls fell significantly compared to a normal situation, mainly on trade routes with the Far East.

Car carrier and ro-ro activity continues to be very weak, while imports of refined products have started recovering in regions which started easing locking measures. More and more ports are reporting under- utilization of liquid and dry bulk storage facilities.

The cruise/passenger market remains the most affected by the COVID-19 contagion: passenger vessel calls are down more than 50% almost everywhere, with negative peaks over 90%.

IAPH indicates that regional differences are becoming more pronounced, as some European ports see some recovery and the number of blanked sailings is decreasing. A different trend is observed in the Americas, where ports are experiencing a strong volume reduction on imports and exports.

Furthermore, some ports in Asia are forecasting a recovery by the end of May and beginning of June in terms of container vessel liner services, which will have a corresponding positive knock-on impact between six to eight weeks later in regions such as Europe and North America.

Global Car Trade

Lloyd’s List confirms the heavy impacts on shipping due to the collapse of demand for new vehicles.

Global car sales demand forecast to fall 21.8%: world market is expected to drop to 70.6m units from 90.3m last year. At the regional level, demand is set to decline 26.5% in Europe, 43.9% in South America, 12% in China and 50% in India.

Thus the deepsea vehicle trades is experiencing a heavy slump, with up to 200 pure car and truck carriers thought to be idle as operators struggle to cope with falling cargo volumes. Sailings are being blanked, while ports that handle car imports and exports are clogged with vehicles that cannot be moved because showrooms in many of the big consumer countries remain closed.

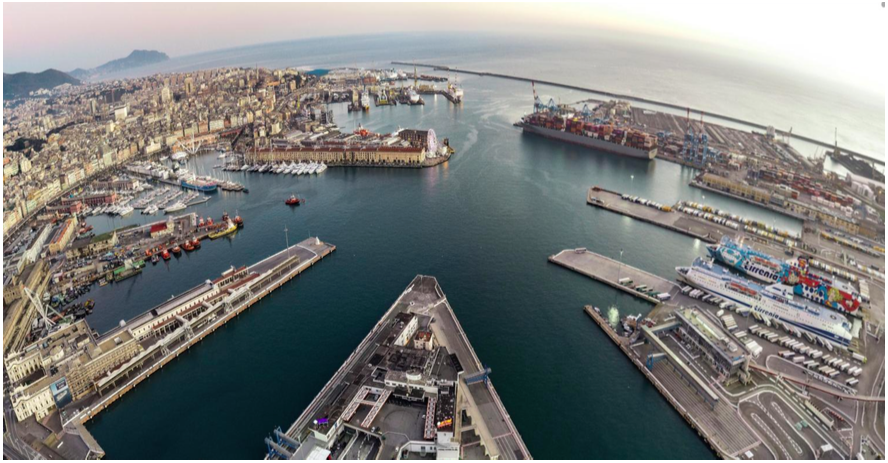

Ports of Genoa - Jan-Apr Traffic Trend

Container traffic

In April the container throughput dropped by 15.8%, registering a total of 192,284 TEU.

- Trade along the Far East routes decreased by 10%, totalling 50,089 TEU.

- Imports from China marked a decline of -11% (corresponding to 18,000 TEU), an even sharper drop was recorded on flows from Singapore (-16.0%, -8,890 TEU).

- Middle East trade was consistently down (-14.1%), in fact, imports decreased by 42.5%, whilst exports fell by 3.5%. On the one hand traffic towards Saudi Arabia registered a 28.8% decline, while, on the other hand, trade with Emirates increased by 1.2%.

- With reference to Westbound routes, container traffic towards North America and South America suffered a setback of 31.7% and 69.4% respectively.

General Cargo

Conventional cargo volumes showed a dramatic fall in the first four months of 2020, with Ro-Ro traffic recording a – 17.5% decline, that in April reached a downward peak of -44%, due to the stop of most of international Motorway of the Seas services.

Bulk cargo

In April liquid bulk traffic marked a sharp drop, because of the fall in mineral oils (-44.5%) and in other liquid bulk (-17.3%), specifically vegetable oils fell by -21.5%.

Dry bulk volumes recorded a brusque -50.6% reduction due to low market demand.

Passengers

Passenger traffic, after the strong growth in the first two months of the year (+23.8%) when a record 266,000 pax were registered, in March signed a decline because of the suspension of all passenger liner services, and in April reached the heaviest setback with a contraction of 98.4% and a total amount of only 5,219 passengers.

As regards cruise activity in particular, due to the widespread halt to cruise ships, only 1,494 passengers disembarked in Genoa in April (returning from the world tour on board of Costa Deliziosa).

Ferry passenger traffic is currently limited to a few pre-authorised services between the Italian peninsula and the major Italian islands operated by Tirrenia ferry line, and recorded a drop by 96.4% in the month.