Global Economic Trends

Although the May PMI figures for a swathe of advanced economies are still well below the 50-no change level, we are cautiously optimistic that output will stage a modest rebound this month. With some exceptions, lockdowns have not yet been eased significantly. But timely alternative data point to changes in people’s behaviour that could spur activity. The Dallas Fed’s social distancing indicator suggests a peak in late April in the US. Apple and Google mobility data paint a similar picture for the US and other economies.

Recent inflation data releases confirm that lockdowns seem to be pushing down core inflation, although it’s important to note that many goods and services in the inflation basket have been effectively unavailable. Still, economies not in lockdown such as Sweden and South Korea have also seen underlying inflation slow, even in sectors that are potentially susceptible to higher costs from social distancing such as restaurants.

Shipping & Logistics

Container Shipping

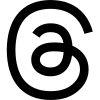

Despite the total distance for ships taking the Cape of Good Hope route from Rotterdam to Singapore is more than 3,000 nautical miles longer than the one via Suez Canal (11,720 vs 8,440), since the end of March, Alphaliner has tracked at least 20 sailings that used the longer Cape route to avoid paying the Suez Canal tolls.

Nine eastbound Europe - Asia sailings, eight eastbound US East Coast - Asia sailings and even three westbound Asia - Europe headhaul sailings by CMA CGM have also chosen to take the longer route.

While Cape diversions on the eastbound (backhaul) trade from Europe and North America to the Far East are not that uncommon, it is unusual that westbound ships take the longer Cape route, due to the transit- time sensitive headhaul, but low bunker price and lack of demand in European markets have suddenly made such options viable.

Through these moves, shipping companies are able to reduce their costs, offloading the burden on the public side, in terms of increasing emissions and reduced incomes for the Suez Canal Authority, which has lost $10M already and is forced to grant discounts to discourage route diversions, after the huge investments in the recent years aimed at enlarging the canal to cope with increasing vessel dimensions.

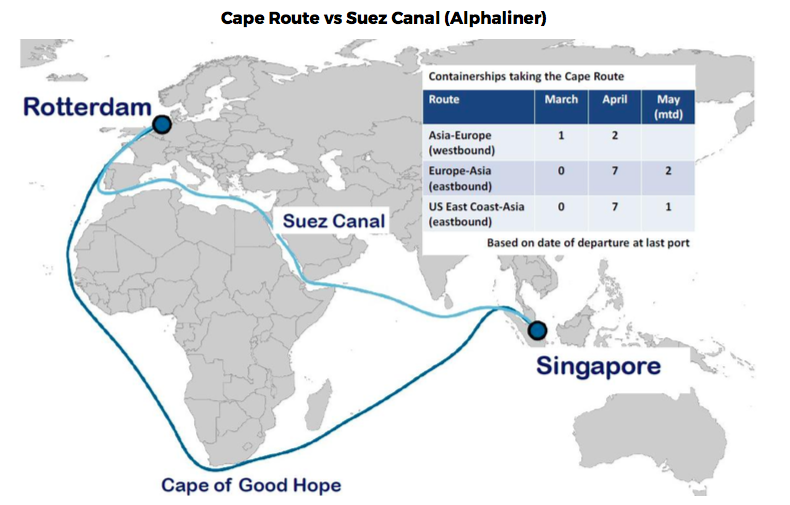

Discussion during TOC Events Webinar “The ‘New’ New Normal: Will Supply Chains be the Same Again after COVID-19?” highlighted the limited hope of bounce-back in demand for container shipping this year and predicted capacity reduction policies by shipping companies in Q2 are likely to continue in Q3.

World Ports

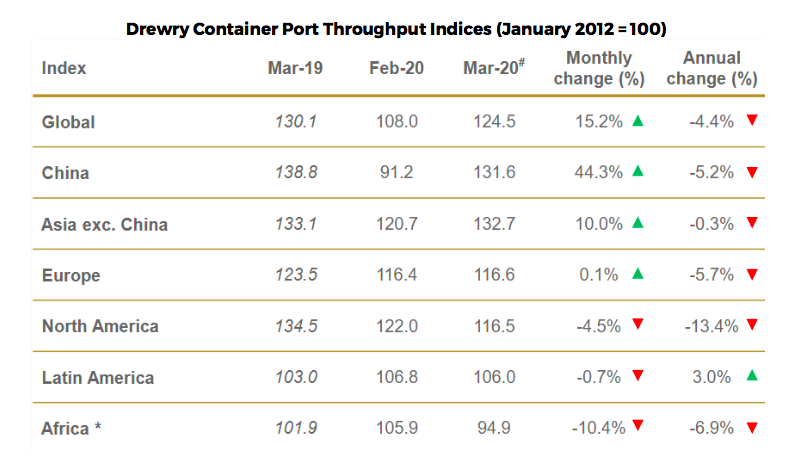

According to Drewry, in March 2020, the global container port throughput index bounced back to 124.5 points after declining 20 points in February 2020, due to the reopening of Chinese factories and ports. Still, this result is six points lower than the figure of March 2019.

Europe’s throughput index, in particular, was almost the same as in the previous month, but the annual trend is 5.7% lower, with Mediterranean ports feeling the effects of the Chinese port disruptions. The North America throughput index further declined by 5.5 points (4.5%) in March, following the steep fall in February 2020.

During the Union for the Mediterranean Forum “Impacts of the COVID-19 pandemic on Ports and Maritime Transport in the Mediterranean Region”, Olaf Merk (OECD - International Transport Forum) highlighted the risks of “race to the bottom” among Mediterranean ports as they are offering shipping companies port dues discounts with the aim to tie ships to their terminals.

While shipping companies can use different leverages in order to keep their balances under control (slow steaming, longer routes, blank sailings, increasing rates), ports are a weak element along supply chains as they do not have any option to reduce their fixed costs and stay competitive.