Global economic trends

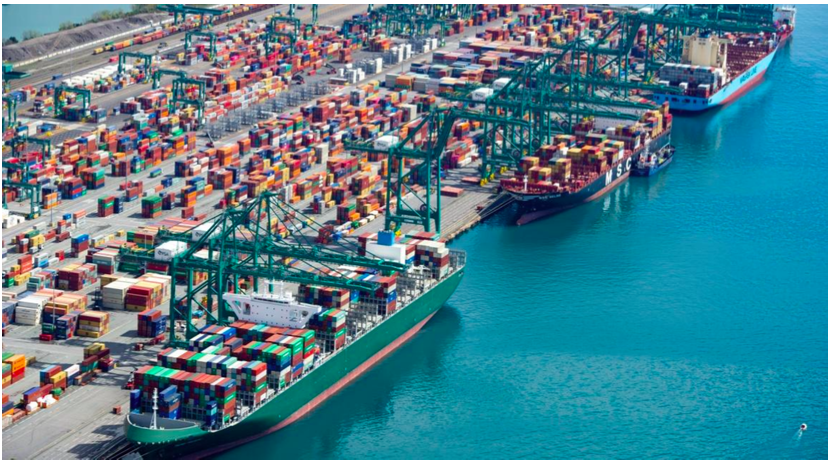

According to UK based analysts Oxford Economics, the pandemic will have a huge impact on world trade. Steep falls in industrial output will hit trade in goods hard, while the unusually service-driven nature of the emergent recession also means services trade will plummet. Total world trade in goods and services could fall by 10%-15% in 2020, compared to a 10% decline in 2009 during the global financial crisis.

Indicators already point to a double-digit fall in freight trade in March-April. This fits in with historical evidence that goods trade tends to fall faster than GDP in downturns due to the high trade intensity of industry. Goods trade may fall 8%-15% this year in different macroeconomic scenarios.

Services are generally less trade-intensive than industry, amounting to only one-fifth of total world trade. But we estimate that the massive contraction in the service sector that we are forecasting could slash world services trade by 18% this year – much worse than in 2009.

Oxford Economics underlines that their estimates might even be surpassed to the downside as trade decline in crisis periods is affected by rising trade costs and by further conservative strategies as de-stocking and financial dislocations.

EU policy

The COVID-19 outbreak is having a major impact on transport and connectivity in the EU. Measures to contain the outbreak have resulted in a dramatic reduction in transport activity, especially in passenger transport. Freight flows have been less affected, in part thanks to collective EU efforts to ensure that freight continues to move, although there has been a reduction due to declining economic activity and disruption of supply chains.

On 13 May 2020, the European Commission released important packages of guidelines and recommendations about post-COVID economy re-launch, specifically aimed at travel and tourism and transport connectivity.

Through the Tourism and Transport package, in particular, the Commission intends to guide and help Member States gradually lift travel restrictions and allow tourism businesses to reopen, after months of lockdown, while respecting necessary health precautions.

The package also aims to help the EU tourism sector recover from the pandemic, by supporting businesses and ensuring that Europe continues to be the number one destination for visitors.

The package defines includes:

- An overall strategy towards recovery in 2020 and beyond;

- A common approach to restoring free movement and lifting restrictions at EU internal borders in a gradual and coordinated way;

- A framework to support the gradual re-establishment of transport whilst ensuring the safety of passengers and personnel;

- A recommendation which aims to make travel vouchers an attractive alternative to cash reimbursement for consumers;

- Criteria for restoring tourism activities safely and gradually and for developing health protocols for hospitality establishments such as hotels.

Through the specific COVID-19 Guidelines on the progressive restoration of transport services and connectivity, the Commission has issued guidance on restrictions on non-essential travel and put forward measures specifically for transport, including guidelines for border management measures, on the implementation of Green Lanes for freight transport, on facilitating air cargo operations and on seafarers, passengers and other persons on board ships.

The Commission has also offered guidance on how best to protect transport workers and passengers, while keeping freight moving.

As long as restrictions on the movement of persons remain in place and freight flows also remain liable to be affected, these measures and recommendations on the flow of goods, free movement of workers exercising critical occupations, transit and repatriations of passengers and crews should continue to be applied consistently and in a co-ordinated way by all member states.

Member states should continue using the network of national transport contact points for the COVID-19 response co-ordinated by the Commission.

As the public health situation begins to improve, it will be important that transport services and connectivity are progressively restored within the limits that the epidemiological conditions allow, since they are key enablers of the EU and the global economy, and fundamental parts of the daily lives of EU citizens.

Transport and Logistics in Italy

According to the analysis of a pool of specialists led by prof. Ennio Cascetta, one of the main Italian experts in the transport industry, following the pandemic underway, the world economy is in a situation of deep uncertainty, which weighs particularly on the transport sector affected by the collapse in demand.

The logistics and freight transport cluster in Italy suffers from the same difficulties experienced by other industries: contraction in demand, lack of liquidity, difficulty in accessing credit, complex organization of work due to the social distancing measures.

Furthermore, this sector in Italy is traditionally characterized by a high fragmentation, therefore only the financially more solid companies, less exposed to debt and able to innovate through a more pervasive use of technologies, will be able to survive.

This backlash will change the transport and logistics scenario, producing painful failures but, at the same time, opening up the possibility of mergers, rationalizations and efficiency improvements in the sector.

Looking ahead, Prof. Cascetta indicates the need to build a functional and resilient transport and logistics system, capable of providing route and mode alternatives for the transport of goods. “Thinking resilient” means looking for and enhancing redundancies that in the past have been tried to avoid because they are considered a source of inefficiencies.

As an example, the pandemic calls into question some of the undisputed principles of pre-CoVid-19 supply chains, such as the concentration of flows and just-in-time productions, which now from strengths can turn into critical issues, because of the scarce routing alternative and of the limited stocks.

Tag: