Global Economic Trends

The OECD in its latest Economic Outlook reveals the projected impact the COVID-19 pandemic will have on global GDP in 2020. When assuming there will be no second wave of infections in 2020 GDP is currently expected to be down by 6% on last year. Should we encounter a 'double-hit' scenario however, this is forecast to increase to a 7.6% drop.

Italian GDP is projected to fall by 14% in 2020 before recovering by 5.3% in 2021 if there is another virus outbreak later this year. If further outbreaks are avoided, GDP is projected to fall by 11.3% in 2020 and to recover by 7.7% in 2021.

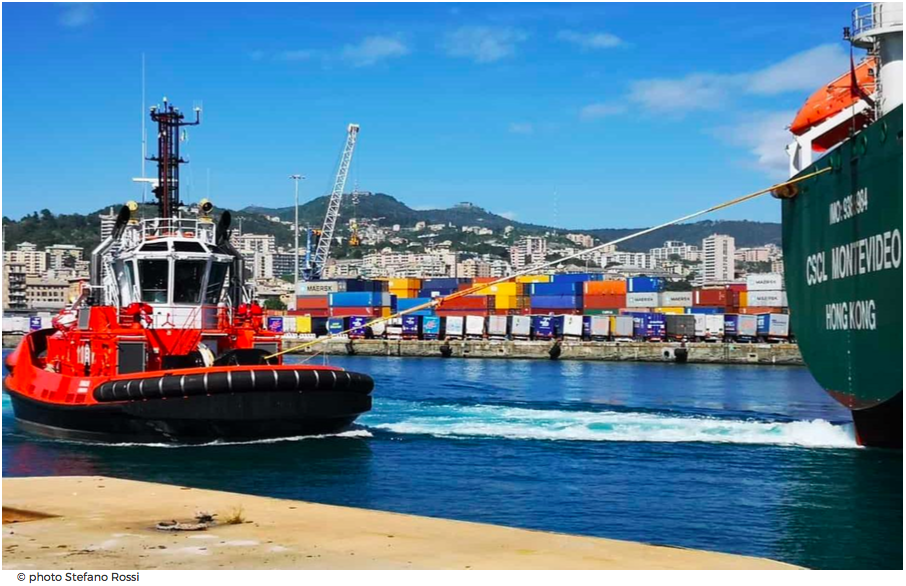

Shipping & Logistics

Container Shipping

According to IAPH Barometer, blank sailings continue to affect container trade, mainly on trade routes with the Far East, even if their impact is lowering.

Overall, a very fragmented situation for containers is becoming evident: some alliances have revamped services, whilst others are keeping cancellations. A new regional concept for transhipment appears to be emerging, with high-frequency feeders from main hubs to regional ports.

In week 22, about 39% of the ports (against 45% in week 21) are reporting that the number of container vessel calls fell by 5 to 25% compared to a normal situation, while half of the ports indicate that calls by other cargo vessels is rather stable. The passenger market remains the most affected by the COVID-19 contagion, due to the almost complete cessation of cruise activities.

Several ports reported that with the lockdown period of the respective economies over, they head towards increased economic activities comparing to past weeks. The regional results clearly demonstrate that the situation in Europe peaked in week 19 and has shown gradual improvement since then, while in the Americas there are no clear signs yet that the situation is improving.

JOC reports that extensive capacity cuts will be prolonged throughout Q3, as THE Alliance and 2M Alliance have announced another 521,000 TEU of blank sailings. By the end of August (week 34), carriers on Asia-North Europe will have cancelled 67 sailings since the end of March, and 51 sailings on Asia-Med, as a direct result of the volume decline caused by the Coronavirus. Sea-Intelligence found that THE Alliance will blank 22% of its capacity on Asia-North Europe, and 2M will blank 20%, while on Asia-Med, THE Alliance will cancel 25% of its sailings, and 2M 20%.

Digitalization

As reported by JOC, a coalition of 10 maritime groups led by IAPH, is pressing the shipping industry to move aggressively toward digitalization as ports grapple with the impacts of the COVID-19 pandemic.

Among a list of nine priorities to be pursued by the coalition are broader use of single window-based port community systems, harmonization of data, and fostering port data sharing environments.

Those initiatives, if realized, would allow for a less “heterogeneous landscape” between ports globally than currently exists. The asymmetric development of port community systemshas contributed to an environment where some global container gateways have made progress as digital data and service hubs, while others languish behind, dependent on either disconnected and antiquated central systems or the private sector to essentially manage critical port activities.

The World Ports Sustainability Program COVID-19 Task Force highlighted the urgent need for ports to digitalize processes and data exchanges as we move towards a post-COVID-19 modus operandi: exchanging paper by hand and relying on person-to-person interaction is no more a viable approach neither from a safety nor efficiency standpoint.

The coalition is also encouraging ports to create additional e-business solutions, share data to optimize port calls, as well as effectively deploy resources by logistics providers to handle and clear cargo handling.

Ports of Genoa - Jan-May Traffic Trend Forecast

Container traffic

Port container throughput is projected to fall by 28.7% compared to May 2019, registering a total of approximately 169,000 TEU.

- The contraction is mainly due to the closure of manufacturing activities in many countries served by the Ports of Genoa, in addition to the reduction in volumes and calls caused by blank sailings.

- PSA Genova Prà terminal reports the sharpest decline (in absolute value) of approximately -32.5% and according to the terminal operator the negative trend will continue across June.

- Vado Gateway throughput is forecast to remain in line with volumes registered over the 4 previous months.

General Cargo

Conventional cargo volumes, which showed a dramatic fall in the first four months of 2020, with Ro-Ro traffic recording a -44% in April due to the stoppage of most of the international Motorway of the Seas services, are heading for a slight recovery in May, albeit with still lower volumes compared to May 2019.

Bulk cargo

In May liquid bulk is forecast to fall, but at a slower pace than in previous months since petroleum products have started to recoup in countries which introduced a relaxation of lockdown measures, despite the OPEC+ cuts in supply.

In addition, the dry bulk trade outlook is set to be poor due to lower commodity demand as a direct result of the lockdowns, as well as from the ensuing economic slowdown.

Passengers

The passenger market remains the most affected by the COVID-19 contagion. In fact, passenger traffic which fell by 98.4% in April, with a total of 5,219 passengers, in May is forecast to remain in line with April throughput levels since cruises are still halted and, to date, ferry passenger traffic is limited to a few services between the Italian mainland and the major Italian islands.

Tag: